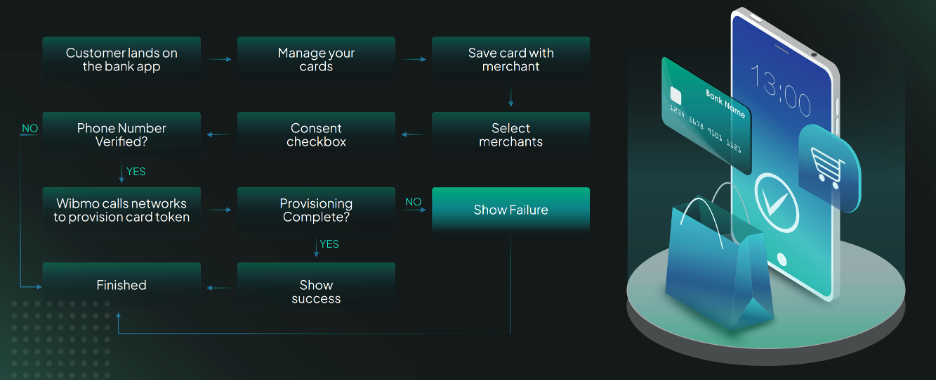

Push Token Provisioning

RBI had released the circular in December 20, 2023 stating that the cardholders will be able to tokenize their cards on list of merchants through a banking platform either by mobile or internet banking channel.

It is a faster way to share payment credentials between merchants & banks. Using Push Tokenization, tokens will be created at the issuer bank level and linked to their existing accounts with various e-commerce apps/ website.

Key Benefits

ü Increase transaction security, resulting in reduced card data related frauds

ü Eliminate the need for a customer to recall their card details, making payments simpler and faster

ü Cardholders can manage all the tokens through a single bank channel

ü Provides a more frictionless card payment experience and reduces the overall checkout time

ü Banks can increase card activation by running offers on the mobile application to get customers get card activated quickly

Schemes Supported : Visa, Mastercard, Rupay, Diners and Issuer Tokenization

Updated 9 months ago